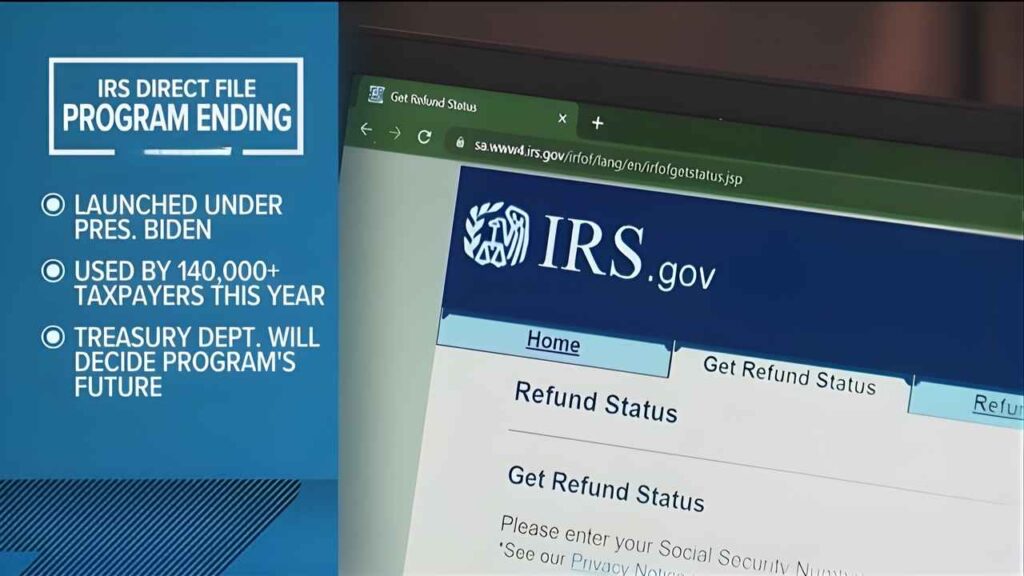

The IRS officially discontinue Direct File, the government’s no-cost digital tax tool that once made filing simple, fast, and frustration-free.

Its sudden exit leaves millions of taxpayers wondering what the next tax season will look like without a free, government-run option.

While federal officials argue this move redirects resources more efficiently, taxpayers worry the shift strengthens the hold of commercial tax software companies.

The big question now; what changes, who loses access, and which free options remain, if any? Here is the straightforward, up-to-date guide Americans need before they file again.

Goodbye Direct File, Hello New Tax Rules

The end of IRS Direct File removes one of the most straightforward and transparent tools for filing federal taxes. Users now shift to a mix of private-software partnerships and volunteer-based programs, each with different rules and availability. That change spark concern, especially among taxpayers who valued a clean, government-operated system that never tried to sell them upgrades.

Across tax-policy discussions, the buzz centers on whether federal officials will ever revive Direct File or explore a stronger public alternative. For now, Americans must get familiar with the remaining free options and stay cautious of paid software disguised as “free”.

Free IRS Filing Ends & New Tax 2026 Key Details

| Latest Update On | IRS Direct File Shuts Down & New Tax Reality in 2026 |

| What Ended | Direct File Permanently Shut down |

| Who Feels It | Low- and middle-income taxpayers relying on a free federal system |

| Lost Benefits | One unified, no-fee, no-upsell government tool |

| Main Alternatives | Free File, Fillable Forms, VITA |

| Credits | Unchanged, but filing process varies |

| Action Steps | Identify eligibility, prepare documents, avoid paid traps |

| Where to Get Help | IRS, VITA, Free File providers |

What Actually Changed?

Direct File; once promoted as a streamlined and fee-free way to submit federal tax returns permanently shut down.

The Key Changes Include:

- The platform is no longer available for the next tax season.

- IRS funding designated for Direct File will now support other programs.

- Users must switch back to commercial software or IRS-supported alternatives.

- States that previously integrated with Direct File must return to pre-pilot methods.

The decision removes the only federal tax tool that operated without upsells, hidden charges, or corporate incentives.

What Made Direct File Valuable & What Taxpayers Lose

Direct File stood out because it eliminated the uncertainty that comes with commercial software. People knew exactly what they were getting; a free, government-backed filing system.

What Disappears With Its Shutdown –

- A guaranteed free federal filing option for all income groups.

- Straightforward, step-by-step question-and-answer guidance.

- A filing experience without advertisements or paid “add-on” nudges.

- A direct connection to IRS systems for accuracy and security.

- The ability to claim key credits without extra fees.

- A uniform national platform instead of scattered third-party tools.

What Replaces It?

- Expanded IRS Free File partnerships

- VITA-based assistance for eligible groups

- Promised but vague, improvements to existing digital tools

For many taxpayers, this transition feels like trading a dependable public service for a patchwork of inconsistent private-sector alternatives.

Who Qualifies For Remaining Free Filing Options?

Now that Direct File is gone, taxpayers fall into specific eligibility categories.

1. IRS Free File (Income up to $84,000)

- Best For –

- Individuals or families with moderate incomes.

- Those comfortable using branded software under the IRS Free File partnership.

2. IRS Fillable Forms (No income limits)

- Best For –

- Taxpayers who prefer manual entry.

- Filers who don’t need guided help or built-in checks.

- Individuals with straightforward, error-free familiarity.

3. VITA (Income up to $67,000 or other qualifying conditions)

- Best For –

- Lower-income families.

- People with disabilities.

- Filers with limited English proficiency.

- Those who prefer in-person assistance.

Millions who use Direct File will now slot themselves into one of these categories depending on income, access, and comfort level.

Steps Taxpayers Must Take After Shutdown

- Know Your Filing Category

- Under $67,000 – VITA or Free File.

- Under $84,000 – Free File.

- Over $84,000 – Fillable Forms or private software.

- Review Updated Eligibility Rules

- Free File software partners often change their income limits and restrictions each year.

- Gather Key Documents Early

- Employment forms (W-2, 1099 series).

- Social Security statements.

- Investment or interest income forms.

- Stay Alert For Paid Upsells

- Some commercial platforms advertise “free filing” but shift users into paid versions subtly.

- Use IRS Official Resources When Unsure

- IRS.gov detailed explanations, comparison charts, and locator tools.

Are Tax Credits Changing Too?

No major federal credits are being altered due to the end of Direct File. The Child Tax Credit, Earned Income Tax Credit, education credits, and others remain intact.

However, Process of Claiming Them May Feel Different –

- Some software companies charge extra for credit-related forms.

- Free File providers may not support every credit.

- VITA sites vary widely in location and availability.

- Manual filers using Fillable Forms must complete credit calculations without guidance.

So while the credits stay the same, the pathway to obtaining them becomes more complicated without Direct File’s built-in tools.

Where to Seek Help?

- IRS General Assistance – 800-829-1040.

- VITA Help & Locations – irs.treasury.gov or 800-906-9887.

- IRS Free File Hub – IRS.gov/freefile.

- State Tax Agencies – Visit individual state revenue websites.

These remain the most reliable sources for accurate, no-cost support.

IRS Pulls Plug on Direct File – What Happens Now?

Direct File’s shutdown reshapes how the nation approaches tax filing. It adds new decisions, more eligibility rules, and a heavier reliance on private companies.

But with early preparation, the right tools, and awareness of available programs, taxpayers can still navigate the system without unnecessary costs.

Staying informed is now more important than ever and the next filing season will test how smoothly Americans can adapt.